01 Feb 2022

Will the Bank of England increase interest rates?

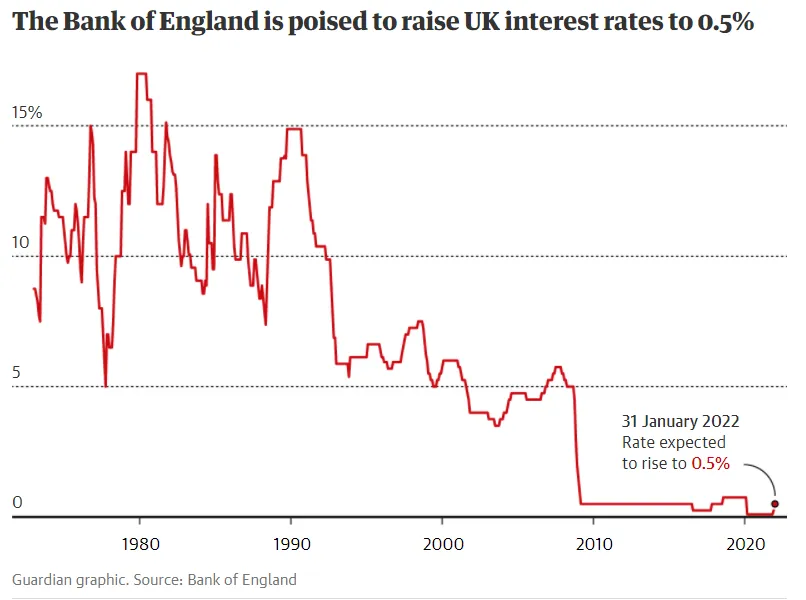

With the first Monetary Policy Committee (MPC) meeting of the year to be held Thursday (3rd February), the feeling is that we are to see the first of several interest rate rises of 2022.

The Office for National Statistics reports the inflation rate at 5.4% well above the 2% Government target. Given rising energy prices it is likely we will see rates of 6% by April.

The MPC is widely predicted to vote for a base rate increase of 0.25% Thursday 3rd February taking the base rate to 0.50%.

Further rate rises are expected throughout this year with some economists forecasting we will end 2022 with rates at 1.5%.

Should this be the case, for those borrowers sitting on tracker rate mortgages, your payments will change immediately.

Borrowers with standard variable rate deals are also likely to see an increase as banks make the decision to pass on any increase in the cost of borrowing to customers.

Want to know more? Contact us today!